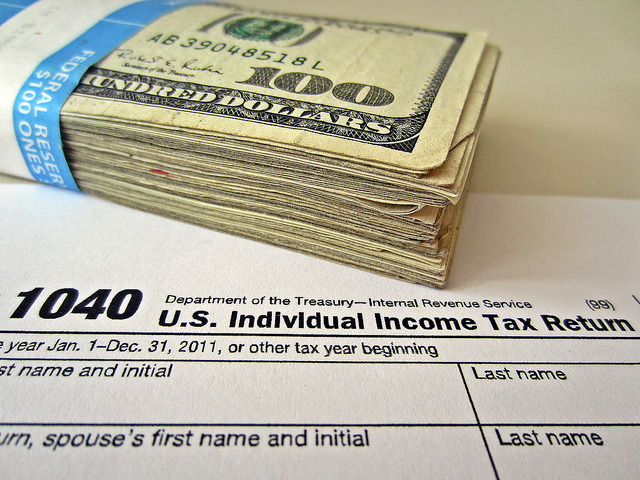

Waiting for that big tax refund to hit your bank account? You aren’t alone. An estimated 74% of people received a tax refund in 2017 and, according to the IRS, those refunds averaged about $3,000 per filer. Should you blow …

Read more

Filing your taxes doesn’t have to be so stressful. Los Angeles Financial Planner David Rae shares some tax advice with Inside the Issue with Alex Cohen.

View Video

Tax Audit Risk The only thing people hate more than filing their taxes might just be an IRS Audit. Learning of a large tax bill would probably take third place. In reality, the risk of being audited is quite low. …

Read more

Spectrum News Tips for Tackling Tax Returns this Tax season. David Rae and Alex Cohen Inside the issue

View Video

With Marriage Equality come more options for Gay Retirement Planning. LGBT Retirement Expert David Rae outlines how love wins for gay couples.

Read more

Maximize Your Tax Refund – Or should you just Blow It? Are you looking to put your tax refund to good use? Here are a few tips to maximize your tax refund, rather than just blowing it. David Rae Financial …

Read more

Tax Season 2021 is here- and that means you may be asking- Should I put my taxes on a credit card? For those of you who love racking up airline miles or earning cash back, paying your taxes on a …

Read more

Financial Planner Shares Tips to Maximize Your Retirement Income by making smart Required Minimum Distribution choices.

Read more

6 ways to reduce your risk of being a victim of tax fraud. This crime is on the rise and can be time consuming and costly.

Read more

LGBT couples face a unique set of Tax Planning Challenges. We share 6 tips to help gay couples lower their taxes before year end.

Read more

Your Top 4 Social Security Questions Answered, to make sure you are getting the most from your Social Security Benefits. We all want to make sure we are making the most of our Social Security Benefits. For many Americans, their …

Read more

Do you make too much for a ROTH IRA? The Rich People ROTH may be the answer. For love or money . . . and maybe even a tax break, Cash Value life insurance may be the key to financial …

Read more

The Future of Financial Self-Sabotage 10 Surefire Ways to Never Become a Millionaire. When Austin Power’s Dr. Evil set out to extort the world for a million dollars we all cracked up. How quaint, we giggled, when everyone knows that …

Read more

The Tax Credit vs. Tax Deduction Quiz Tax season is upon us and while you don’t have to master zillions of pages of the US tax code, it does pay to know a few of the basics. Test your knowledge …

Read more

Donald Trump turned a billion dollar loss into a way to pay no income taxes for years. Financial Planner LA discusses in this video for Nightline with Nick Watt.

Read more

One of the biggest advantages of owning a home in California is Proposition 13. This limits how much your property taxes can go up each year. Many long-time homeowners are paying property taxes based on an assessed value that is …

Read more

Always Avoid the Alternative Minimum Tax: Financial Advice to Break Part 3 Avoiding the alternative minimum tax (AMT) is usually top-of-mind for individuals who receive valuable stock options from their employers. This is especially true when those individuals own substantial …

Read more

Tax Day Tips ABC News with Financial Planner LA Tax Day Tips, and other overlooked Tax Deductions you might be missing. Financial Planner LA David Rae appears on the ABC Eyewitness News here in LA with anchors Elex Michaelson and …

View Video

Tax Planning Los Angeles in light of the GOP Tax Bill – CBS News covers what it may mean for you and your finances. With Guest Financial Planner LA David Rae speaking with Jeff Michael and Kara Finnstrom. I was …

View Video

There are a slew or reason the GOP Tax Reform bill is so unpopular. Most people think their tax bills will actually go up under the new plan, and many of them are right. Check out this video from ABC …

View Video