I am excited to share this video produced by Forbes.com, which features Financial Planner LA David Rae sharing 6 ways to get even more tax-free income in retirement. Click here to WATCH VIDEO I’ve never met anyone who loves paying …

Read more

Does your Los Angeles Financial Advisor offer tax planning guidance? They may no even be allowed to offer tax saving tips. What you need to know to get the best tax advice.

Read more

Are Social Security Taxable? What is the maximum amount you can receive from Social Security Retirement? These and you other questions answered by Financial Planner LA.

Read more

Investment risk and stock market volatility are not the same thing. You may earn below-average stock market returns when the markets are calm. Or perhaps you make outsized returns when the stock market appears scary times of extreme volatility. Financial …

Read more

The holidays are fast approaching, which means it is time to start doing some year-end tax planning. The Tax Cut and Jobs Act will mean lower tax bills for many Americans. That does not mean you can ignore tax planning. …

Read more

What is the true value of working with a Fiduciary Financial Planner? Fiduciary Financial Planner Los Angeles weighs in. Why seeking – and heeding – financial advice from a Fiduciary Certified Financial Planner may prove beneficial, some might even say …

Read more

Looking for more tax deductions to help your business pay fewer taxes? A Cash Balance Pension Plan may be the keep to keeping more of your hard earned money.

Read more

You need to know the SEP IRA contribution limits to make sure you can minimize the taxes on your small business income.

Read more

The Biggest Mistake You Are Making with your 401(k)k could cost you over a million dollars. For some of you, it could lower your 401(k) balances by several million dollars. We are facing a retirement planning crisis in America. Boomers, …

Read more

Investing Mistakes to Avoid. 3 big investing mistakes to avoid, if you don’t it will cost you a bundle. I’m extremely lucky to have a smart and successful group of clients, many of whom came to me after falling victim …

Read more

Could you handle a Retirement like Grace and Frankie? Even with gay ex-husbands and straight ex-wives to deal with, growing older can still be filled with adventure and possibility . . . as long as you’ve got the wherewithal to …

Read more

At least once every few months a long-term client brings in a retirement account statement and says, “I forgot I had this retirement account. Can you help me with it?” Sometimes these accounts are tiny but other times they hold …

Read more

With Marriage Equality come more options for Gay Retirement Planning. LGBT Retirement Expert David Rae outlines how love wins for gay couples.

Read more

Will retirement be better or worse for the LGBT Community? While the LGBT community is benefiting from increasing financial prosperity and legal recognition, many economic challenges hit us harder than they do for straight citizens. Like everyone else, we are …

Read more

6 Retirement Planning Lies that threaten your Golden years. Retirement often thought of as a far-off and hard to achieve nirvana, here are a few endearing myths that may throw off your financial planning. Here are the 6 Retirement Planning …

Read more

More than 50% of Americans have nothing saved for retirement. Here are 10 big reasons to be just like them and ignore retirement planning.

Read more

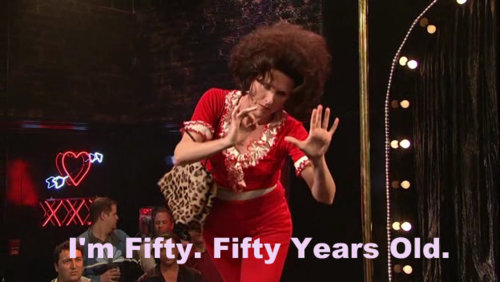

Going on Fifty Facing Retirement. What should I do now? Where do you go from here? LA Financial Planner shares a few tips to help get back on track for retirement. I’m 50 what do I do now? Three points …

Read more

Does thinking about Retirement Planning Stress Your Out? While the economy is improving, retirement saving is falling behind. At Financila Planner Los Angeles we are here to show you how to make the retirement planning process less stressful. Does thinking …

Read more

The housing market is hot these days. How to get ready to buy the home of your dreams without wreaking havoc on your finances.

Read more

The Future of Financial Self-Sabotage 10 Surefire Ways to Never Become a Millionaire. When Austin Power’s Dr. Evil set out to extort the world for a million dollars we all cracked up. How quaint, we giggled, when everyone knows that …

Read more