Financial Planner Palm Springs David Rae has been helping friends of the LGBT community achieve financial security as a Certified Financial Planner™ and Accredited Investment Fiduciary® since 2003. David is a proud homeowner in both Palm Springs and Los Angeles. We help ensure you have an income you won’t outlive, all while enjoying a Happier, Healthier and Wealthier Retirement.

By David Rae Certified Financial Planner™, Accredited Investment Fiduciary™

Palm Springs Financial Advisor David Rae advises his clients and their families on getting their financial houses in order. Developing investment strategies and tax planning strategies to meet their goals and financial planning for their retirement. He has also built a strong reputation as a Palm Springs financial specialist serving the needs of individuals, couples, and business owners in and around the LGBT community. While he splits his time between Los Angeles and Palm Springs, he has clients across the country and throughout Southern California. As a gay financial planner, he understands the allure of a Palm Springs retirement.

Financial Planner Palm Springs

In addition to his regular Financial Planner Palm Springs blog posts, he also writes regularly for Forbes.com and blogs for The Huffington Post and Investopedia. David Rae is a featured financial columnist for The Advocate magazine as well as an in-demand Palm Springs Financial Expert for quotes and insights ranging from VOGUE to TIME and even things like Money Magazine.

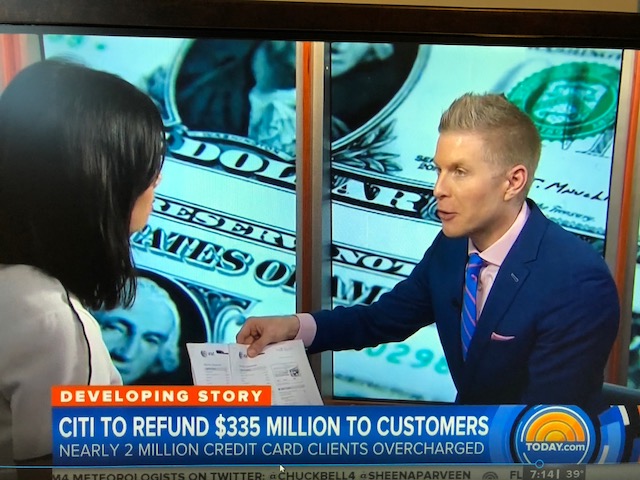

To engage and intrigue his readers, Palm Springs Financial Planner David Rae frequently references pop culture to illustrate how money, attitude, and behavior influence each other, whether for good or for ill. David Rae is no stranger in front of the camera either, having been interviewed for over 200 TV segments on Nightline, the Today Show, NBC Nightly News, ABC, KTLA, CBS NBC, and KCAL News broadcasts, as well as appearing on Bravo TV shows like “Newlyweds” and “Kathy Griffin My Life on the D-List.”

David Rae was named one of the “100 Top Financial Advisors” for 2017 by Investopedia. Investopedia again named Palm Springs Financial Planner David Rae as one of the 100 Financial Advisors in 2017, 2018, 2019, 2020, 2021 and again in 2022. He is honored to be the only Palm Springs Financial Planner to make this list of top Financial Advisors.

DRM Wealth Management is a Palm Springs Gay Owned and Gay Run RIA – Registered Investment advisory – proudly serving the financial planning needs of the Palm Springs Area. You have come to the Best Palm Springs Financial Advisor for your journey to financial freedom and getting more happiness from your wealth building.

An estimated 33-50% of Palm Springs are gay males or other members of the LGBT community

Who Financial Planner Palm Springs Works With

We strive to bring you massive value from working with us. This may include increased financial security, reduced financial stress, growing your net worth over time as well as minimizing your taxes. Here are 4 areas where we excel the most:

–Friends of The LGBT Community in Palm Springs- DRM Wealth Management is a gay-owned Wealth Management Firm. Gay Financial Planning is not a luxury you should go without.

–People Within 15 Years of Retirement (Or Already Retired)– now is the time to get serious about your Palm Springs retirement planning.

–High-Income Palm Springs Business Owner Looking to Pay Fewer Taxes– We use a wide variety of tax-minimizing strategies to help you keep more of your hard-earned money.

–People With Stock Options and Equity Compensation – We love our clients who work at Tesla, Apple, SpaceX, and anywhere else that has equity compensation or stock options.

David Rae & Aids Life Cycle Team Popular Raised Over 1 Million In Charitable Donations

The wealth management trade organization’s Registered Rep magazine honored Palm Springs Financial Planner David Rae with its “Adviser with Heart.” Awarded for his inspired work with AIDS/Lifecycle. An avid cyclist himself, he has completed the 545-mile charity bike ride seven times. Additionally, he founded the fundraising machine Team Popular in 2008. His team has since raised over a million dollars to fight HIV/AIDS.

When not working with clients, David enjoys Yoga, working out, and spending time with friends.

David Rae is a graduate of the University of Redlands with a B.A. in Business and Theater. Today, David Rae splits his time between Palm Springs and Los Angeles. He lives with his wonderful husband and their two chihuahuas.

DAVID RAE, CFP®, AIF® is a Palm Springs and Los Angeles Certified Financial Planner™ with DRM Wealth Management, a regular contributor to Advocate Magazine, Huffington Post, Forbes.com and Investopedia, not to mention numerous TV appearances on CBS, ABC, NBC, KTLA, KCAL, Good Day LA and even Fox and Friends. He helps smart people across the USA get on track for their financial goals. For more information, visit his website at www.davidraefp.com

Palm Springs Financial Advisor 92262. Palm Springs Financial Advisor 92264. Planning with Pride since 2003. The gay financial planning for you. Fiduciary Financial Planning Palm Springs.

[…] 2021: Now Offering Gay Financial Planning in Palm Springs and Los Angeles – as well as across the […]

[…] numerous TV appearances. He helps friends of the LGBT Community across the USA (now also in Palm Springs) get on track for their financial goals. For more information visit his website at […]

[…] you live in an expsensive area like Los Angeles, Palm Springs or San Francisco- the home office deduction can be a huge tax saver. As the gay financial […]

[…] Make 2021 the year you finally ignore retirement planning, while sipping a cocktail in Palm Springs….JK […]

[…] million people officially living in California, the great weather and beautiful beaches, mountains, Palm Springs must be doing something right. The hurdles to be financially successful in this state are […]

[…] in retirement planning for the friends of the LGBT community. He lives in Los Angeles and Palm Springs with his husband and their two Chihuahuas. Follow him on Facebook on Twitter @davidraecfp or via […]

[…] more enjoyable area. Just saying. Keeping costs lower in Los Angeles has allowed us to purchase a second home in Palm Springs. Our complex appears to be all gay couples spending part of their year in Palm […]

[…] can afford to ‘keep up’. As a longtime resident of West Hollywood (with a second home in Palm Springs), I can tell you that there will always be someone richer, smarter, skinnier, buffer, or just more […]

[…] get on the same page financially as your spouse. As a Gay Financial Advisor in West Hollywood and Palm Springs, I help many gay couples with their […]

[…] While my (gay-owned) financial planning firm DRM Wealth Management is based in Los Angeles and Palm Springs, I’m well aware of the pressures facing those who do not live in socially progressive locales. In […]

[…] but often those status symbols are merely mirages. They’re not real. Living in West Hollywood and Palm Springs, I can tell you that looks are deceiving. That gorgeous guy driving a Bentley may actually be […]

[…] for gay men, thank you very much, not that this was a big surprise to anyone in San Francisco, Palm Springs, West Hollywood or the West […]

[…] business owners in the highest tax brackets living in places like Los Angeles and Palm Springs, the Rich Person pension could lower your taxes by $500,000 (or more) over the next […]

[…] year, by fully funding this amazing pension plan. The tax savings can be huge. This gay couple from Palm springs was in the highest federal and California tax brackets, pushing their total taxes on the last […]

[…] residence. While $500,000 is a nice exemption, that doesn’t go as far around Los Angeles or Palm Springs as it does in […]

[…] up. You can even use this for short-term goals like a vacation. Or perhaps you are dreaming of a second home in Palm Springs? Think of how much more fun you could have to know your Atlantis Cruise or Provincetown stay is […]

[…] of my Los Angeles Financial Planning client also own home is Palm Springs, another superhot housing […]

[…] to shelter $4 million dollars in income over the next decade. This could help a Los Angeles or Palm Springs business save over $2 million in tax over then ext decade. (Between Federal and California Taxes […]

[…] For those living in high tax states like California, the marriage penalty will likely carry through to your state taxes as well. The top California tax bracket is 13.3% can be quite painful for my clients in Los Angeles, San Francisco and Palm Springs. […]

[…] next housing goal was to buy a second home in Palm Springs, which they have also […]

[…] RAE Certified Financial Planner™, Accredited Investment Fiduciary™ is a Palm Springs and Los Angeles Gay Retirement Planning Specialist with DRM Wealth Management focused on helping […]

[…] household will climb? For now, I will enjoy working and living between home in West Hollywood and Palm Springs, life is […]

[…] whether you are single or married. As a gay financial planner who resides in Los Angeles and Palm Springs, I’ll tell you this is a big deal for many of my clients who are gay […]

[…] Financial Advisor Serving Los Angeles Palm Springs and […]

[…] who is the best fit for you. I am a gay financial advisor working primarily from Los Angeles and Palm Springs, with clients across the country. I tend to meet many people who didn’t feel comfortable […]

[…] seem a much smaller number provide anything coming close to real tax planning. Few Los Angeles or Palm Springs financial advisors even take the time to collect and review their clients’ tax […]

[…] deductions are valuable no matter where you are, but in tax-heavy cities like Los Angeles or Palm Springs, tax planning is even more important for the self-employed and small business […]

[…] Rae Palm Springs Financial Advisor on the CBS […]

[…] head. For others, it means a roof over your head in the Hollywood Hills plus another in Aspen or Palm Springs– your educated guesses are sure to vary […]

[…] Calculating real estate averages is tricky here in my hometown of L.A. because of the vast disparity of wealth between neighborhoods. A 3-bedroom in Lynwood, for example, is going to cost considerably less than the same square footage in Brentwood. It gets confusing, too, because where, exactly, are we talking about? Los Angeles the city or Los Angeles County? Furthermore, when people think of L.A., it’s pretty much limited to the fabulous 310, 323, 213, 424, and selected edges of the 818 area codes. Then, too, the iconic Westside glamazon burgs of Santa Monica, West Hollywood and Beverly Hills are incorporated cities each and of themselves and technically not part of the City of Los Angeles at all (although they are in L.A. County.) Confused yet? Don’t even get me started on the current cost of a second home in Palm Springs. […]

[…] am writing this article in Palm Springs, a place many people move to in retirement. If the move was from a state with taxes lower than […]

[…] financial planner is at their most valuable. Of all the amazing things a great, proactive, progressive financial planner can do for you, avoiding catastrophic investing mistakes when times are scary is often one of the […]

[…] What you need to know about inheriting a home in California, whether West Hollywood, Beverly Hills, Palm Springs or somewhere else fabulous. From Prop 13 to Prop 19 to inheritance taxes to California estate […]

[…] and many of my clients live in locales with high property value. Many even have second homes in Palm Springs. Californians feared the new tax law (The Tax Cuts and Jobs Act of 2017) – enacted last […]

[…] To ensure you protect your finances during these tumultuous times, ensure you are working with a Gay financial planner or, at the very least, a progressive financial advisor. […]