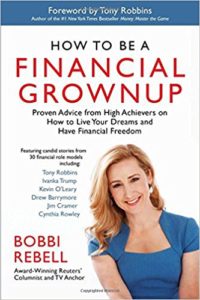

Notes on a Financial Grownup. For this Certified Financial Planner, Bobbi Rebell speaks an important truth – in an age obsessed with youth – in her book How to Be a Financial Grownup.

By David Rae Certified Financial Planner™, Accredited Investment Fiduciary™

Simply stated, what I do as a fiduciary financial planner is to help people make smarter, Grownup financial decisions. In her book How to Be a Financial Grownup, Bobbi Rebell relates stories of ‘Grownup moments’ from the likes of Tony Robbins, Kevin O’Leary, Jim Cramer, and other successful folks.

Indeed, a lot of new clients come to me in response to their own Grownup moments. Sometimes this comes from eagerly stepping into a new role as an adult, as with preparing for marriage or parenthood, for example. Other times it comes from having the role forced upon them by budgetary chaos and the realization that acting like a Financial Child just isn’t working.

Update: There is Now a Financial Grownup Podcast. Financial Planner LA has now appeared on two episodes, give them a listen.

5 Year-End Tax Tips Podcast from FGG

Getting a Roommate as a Financial Grownup Podcast

Financial Planner LA as a Financial Grownup

I’ve personally experienced and witnessed firsthand tons of financial Grownup moments that have shaped the person and financial planner I am today. From an early age, I’ve always been an obsessive saver. I am the polar opposite of ‘fake it till you make it in the fabulousness department. Unlike many these days, a solid financial footing has always been more important to me than creating the illusion of riches that aren’t mine (that is, spending money I don’t have and living on credit). In fact, many of my financial decisions might lead an outsider to assume money is tight. A friend recently quipped “David Rae, you are going to die sitting a big ol’ pot of money!” From his mouth to God’s ear, I say.

In fact, as a relative newlywed – two-plus years in now with the best husband ever, thank you very much – I’ve had to work on relaxing a bit and spending more of my hard-earned money. Before marrying, I was literally saving so much that I was depriving myself of experiences and opportunities you can put a price on. But as an adult and financial Grownup, I recognize that there are certain investments in my health and happiness that I needed to make to LIVE MY BEST LIFE.

It’s all in the balance. I want to live a long healthy life so I shouldn’t skimp on my doctor visits. We plan to live in the house we own for a long time which means that putting off maintenance won’t pay off in the long term. We love to travel and this is a great use of our set-aside fun money.

Goaltending as a smart and savvy Financial Grownup.

It’s safe to say that lots of folks approach money from the opposite direction and either spend every penny they make or take a randomized approach to financial planning. In fact, without a financial plan, many people play with their money like an 8-year-old girl (or boy) who got into their mother’s makeup drawer. All the pieces may be there–a little bit of everything ends up on their faces and all over everything else–but the results aren’t very good.

Childhood is a time for magical thinking where, voila! everything works out for the good and the great. Being a Grownup is the opposite of this. Rewards happen and things work out because you planned for them to work out and you made them work out. Being a Financial Child is about random, being a Financial Grownup is all about purpose.

Put the Pieces Together like a Financial Grownup

Do you ever feel like you have all the pieces for a financial plan but your efforts just aren’t working as they should? You may be saving for a home and are contributing heavily to your retirement accounts. Excellent and swell. Hopefully, you are spending less than you make and have no debt. A-plus, plus. But without an actual financial plan, the results rarely pull together. What’s worse, you are most likely stressing about money all the time but unnecessarily so.

Together, we can do a quick workable makeover of what you are already doing. I can help figure out what you need to save to get into your dream home in the time frame you wanted. Plus, I help my clients find the right allocation and contribution amounts for their various retirement accounts. Everything is done to get you on track for financial independence. Best of all, you may be able to put some money back into their day-to-day spending account so you don’t have to feel so stressed and strapped all the time.

Action plan for your inner Financial Adult

Whether you are a Financial Child or a Financial Grownup, you work with what you have. Either way, it means taking action today to get your financial house in order.

I personally live by my motto, ‘Live for today but save for tomorrow’, to enjoy the best of both worlds. Achieving your financial goals in the future doesn’t mean you have to cannibalize your standard of living today. But to achieve this balance does mean you have to have a strategic plan in place along with clear actionable steps figured out to take you there. You might need professional advice for this and that’s fine; that’s what fiduciary Certified Financial Planners like myself are here for.

As with anything, getting started is often the hardest part. But smart financial choices today will make it easier to stay on the right financial path into the future and increase your odds of reaching financial independence. What exactly is this financial independence I keep going on and on about? Well, it’s the day that working becomes an option and not a necessity. Think about it, there is nothing more Grown-up than having the financial wherewithal to choose work if you want or sail off into the sunset if you don’t.

Extra Credit: Received an Early Retirement Package? Financial Planner Los Angeles talks with Fox Business

Live for Today, Save for Tomorrow! Give Financial Grownup by Bobbi Rebell a read.

DAVID RAE, CFP®, AIF® is a Los Angeles- Certified Financial Planner, a regular contributor to Forbes.com, Advocate Magazine, Huffington Post, and Investopedia not to mention numerous TV appearances. He helps smart people across the USA get on track for their financial goals. For more information visit his website at www.davidraefp.com

First Million is the Hardest How to Build A Million Dollar Net Worth

[…] Extra Credit: How To Be Financial Grownup […]