Fiduciary Rule For Financial Advisors Changes Comment and VIDEO

Are you working with a fiduciary financial advisor or just some salesman pretending to give advice? Are you sure? How to get Fiduciary Financial Advice.

With Smart Spending Los Angeles you will find tips to enjoy life more while spending less. You work hard for the money, might as well maximize it’s value. Our goal is to help you simplify your financial life so you can spend with confidence.

You know you can’t diet your way to an amazing body. Similarly, you can’t penny pinch your way to Financial Freedom. This section of the best Financial Planner LA blog will help you find ways to Spend Smarter so your dollars go farther. Living your best life doesn’t have to cost a fortune, but wasting money may cost you your financial independence.

The Cost of living in Los Angeles is crazy expensive and can make it tough for even the most financially savvy people to struggle financially. Keep reading our post for tips to save on travel, save on taxes, stretch your dollar. Why be stressed about money, when you don’t need to be.

Live for today, Plan for Tomorrow. LA always has something fun to do.

Are you working with a fiduciary financial advisor or just some salesman pretending to give advice? Are you sure? How to get Fiduciary Financial Advice.

Smart Summer Spending Do’s and Don’ts via KTLA News We all want to maximize our money, why pay more than we need to? With a little planning, you can stretch your dollars further without having to cut back. I had …

Will your friends ever pay you back? Do you pay for things and just hope and pray that your friends will pay you back? Financial Planner LA is here to help. We share some tips with the KTLA Morning news …

Citi Bank will be returning $330 million to 1.75 million of its customers. This breaks down to an average refund of around $190 per customer. Jo Ling Kent interviews financial planner David Rae on the Today Show discussing how to …

Stock Market Advice Los Angeles ABC News with David Rae Fiduciary Financial Planner. ABC News Los Angeles recently had David Rae in to get a Certified Financial Planner™ in to give his take on if the recent run-up in the …

How to Lower Your Tax Bill Before 2018 and the GOP Tax Plan As it stands now the proposed GOP tax reforms will take effect in 2018. Looking ahead this means your year-end tax planning may be more crucial …

Retiring a millionaire is really quite simple but it’s not easy. Otherwise, we’d see millions of more people accomplishing this feat. Here is the basic math – to help you see daily, monthly and yearly what it will take to retire a millionaire.

With a reported 1 in 4 victims of the Las Vegas Massacre lacking health insurance, you may see a slew of GoFundMe pages popping up over the coming weeks. Fiduciary Financial Planner David Rae sits down with the KTLA morning …

When Toilet Paper Is Worth Its Weight in Gold? We rarely, if ever, really think about the cost of toilet paper. But as I learned in Havana Cuba, sometimes it could be priceless. My husband and I had the pleasure of …

Powerball has many people dreaming of how they would spend all the Millions or Billions: Will it really make your lives perfect? Mania has set in around the Powerball Winning Numbers. Just when you thought it was safe to be …

Back to School Tips, cheap and easy ways to pay for college. Fiduciary Financial Planner David Rae is in the studio on the ABC 7 Eyewitness News with Ellen Leyva and Coleen Sullivan. College may seem out of reach for …

Show Me the Hamiltons- How much would you pay for Hamilton Tickets on Broadway? Could you imagine spending $42,500 for tickets for anything let alone the phenomenon of Hamilton on Broadway? Update: Hamilton the Musical is playing at the Pantages …

Odd Mom Out is back and more screwed up than ever Season 3 of the Bravo Series Odd Mom Out opens with a tsunami of financial catastrophes. While the Von Webers aren’t exactly everyday people, we can learn from their …

Need some extra cash, and looking to clear out some clutter. We share some tips with KTLA News to help Turn you Clutter into Cash Are you ready to turn your Clutter into Cash? Recently, I appeared on the KTLA …

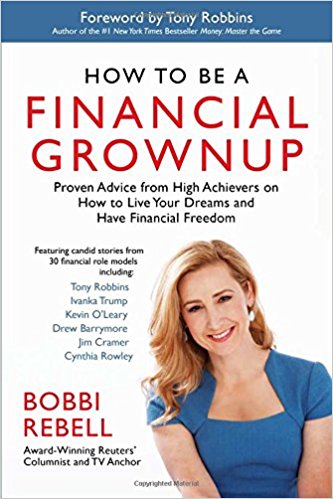

We discuss the book Financial Grownup Guide and Podcast from Bobbi Rebell.

How much Life Insurance do I need? A DIME’s Worth of Life Insurance Questions Answered by Financial Planner Los Angeles. Take a look at this handy formula for calculating how much life insurance you need to protect your family. In …

Click the link above, Enter your email to join Financial Planner LA and join the thousands of people who have downloaded their FREE copy of 10 Big Tips To Get Your Financial House In Order. Tired of feeling overwhelmed when looking …

Is There a Cure for Lifestyle Inflation? Are You Suffering from a bad case of Lifestyle Fever? Yes, Lifestyle Fever is a thing and it may be costing you plenty. Sadly it appears to more prevalent than the common cold this …

Millennial Retirement, how many Millions will you need? Millennials Seeking Millions. According to a recent article in USA Today, older Millennials (DOBs in the 80s) might need to save $1.8 million for retirement while inflation-plagued younger Millennials (DOBs in the …

Yes, Dorothy, It Is Possible to Be Gay Fabulous Frugal all at the same time. 5 Ways to be Gay Fabulous and Frugal. Handling money with aplomb and living well while looking good doesn’t have to be mutually exclusive. You …

© 2025 Financial Planner Los Angeles

This site has been published for residents of California (Insurance License # OE10562), Arizona, Ohio, Florida, and Colorado. All information herein has been prepared solely for informational purposes, and it is not an offer to buy or sell, or a solicitation of an offer to buy or sell any security investment or instrument or to participate in any particular trading strategy. Securities and investment advisory services offered through DRM Wealth Management LLC a Registered Investment Adviser. The videos, articles and other content maintained on this site as well as the opinions voiced in this material are resources for educational and general informational purposes only and are not intended to provide specific advice or recommendations for any individual. No information on this site constitutes financial advice and should not take the place of consulting with a certified financial planner and tax, legal or other financial advisor. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing.