Is the GOP Killing 401(K) Tax Deduction? What will this mean for your financial security in retirement?

By David Rae Certified Financial Planner™, Accredited Investment Fiduciary™

Update 11/2/2017 THE GOP RELEASE THEIR LATEST TAX PROPOSAL WHICH DOES NOT CUT 401(K) CONTRIBUTION- but be aware your taxes may still go up. Tax Reform is still in progress and other changes may come to your retirement options. Stay Tuned.

The latest GOP Tax Proposal is threatening to limit tax-deductible 401k contributions to just $2,400 each year. This is an 87% decrease from the previously announced 2018 401(K) contribution limit of $18,500, per year, for those under 50. It is still not clear whether this will apply to just pre-tax 401(K) contributions or also to Traditional IRAs and other retirement accounts.

I had the pleasure of speaking with NBC Nightly News and appearing in their above segment with Stephanie Ruhle. My fabulous client, Eric Rosen, joined me and shared his concerns about what this change would mean for him, and others like him.

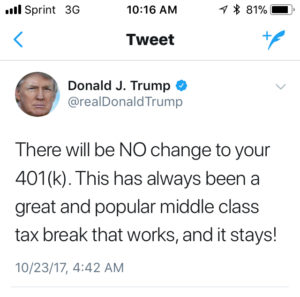

TRUMP on GOP Killing 401(K) Tax Deduction

UPDATE: Trump has contradicted his tweet below and said your 401(K) is at risk of the reform. 10/26/2017

Today, President Donald Trump sent a tweet in which he promised there will be “no change” to tax incentives for the popular 401(k) retirement programs.

As a Certified Financial Planner, I’m here to help my clients reach their financial goals regardless of who is in the Oval Office, or what tax laws are thrown at us. For the sake of the middle class, I hope the proposed changes aren’t passed. People are not saving enough as it is and removing the tax incentive will only exacerbate this problem.

While this may help the government bring in more tax dollars in the short term, it is unlikely to do so in the years ahead. Whatever the outcome, my team and I are here to help our clients make the necessary plans to stay on track for their financial goals.

I’m sure we’ll hear more about this tax debate in the coming days and weeks. Hopefully hard working folks, like you, won’t lose some of their retirement security in order to fund a big corporate tax break.

Live for Today Plan for Tomorrow.

DAVID RAE, CFP®, AIF® is a Los Angeles-retirement planning specialist with DRM Wealth Management. He has been helping friends of the LGBT community reach their financial goals for over a decade. He is a regular contributor to the Advocate Magazine, Investopedia and Huffington Post. As well as the author of the Financial Planner Los Angeles Blog. Follow him on Facebook or via his website www.davidraefp.com

NBC Nightly News video originally appeared live on National TV 10-21/2017.

You may also enjoy:

How Donald Trump Lost Billions and Paid No Taxes Nightline Video

[…] Will the GOP Kill the 401(k) Tax Deduction – Video Featuring David Rae […]

[…] David Rae shares some guidance for lottery winners and other people receiving large windfall with NBC 4 News in Los […]